Why Make a Gift of Securities?

Investing in Toronto’s future has never been easier. By donating a Gift of Securities to Toronto Public library, you are investing in our city and will make a lasting impact on our community’s access to knowledge, literacy, and lifelong learning – while maximizing your tax savings. Click here to download the transfer form.

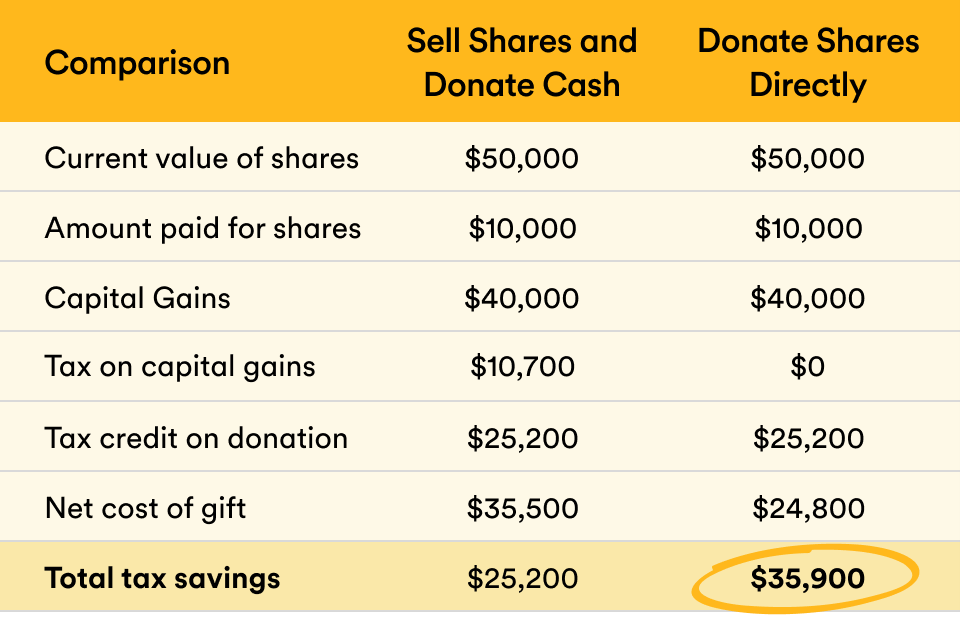

- A donation of publicly-traded securities will eliminate capital gains tax that you would have to pay if you sold the securities and then donated the proceeds. You will also receive a charitable tax receipt for the full fair market value of the donation.

- Securities can include stocks, bonds and mutual funds that trade on the stock exchange. You have the flexibility to make a gift now or include it in your will and estate planning as a future contribution.

- Giving is so easy. Consult your financial or tax advisor to decide which investments make the most financial and philanthropic impact. Get in touch and let us know if you have, or plan to make a gift. We can help guide you through the process, and show our appreciation and how your donation will make a difference to enrich the lives of those who rely on the Library.

Or learn more about making a Gift of Securities on the CRA website

See the benefits

The example above assumes the top Ontario marginal tax rate of 53.5% and top donation credit rate of 50.4%.

*The new AMT rules may impact these calculations for high-income earners. Consult your financial advisor

for personalized advice.

How to make a gift of securities

-

1. Talk to your Financial Advisor or contact your bank

Meet with your financial advisor to determine which investments will make the most philanthropic impact and maximize the benefits for your tax savings.

-

2. Complete and submit the transfer form

Complete the Foundation’s Gift of Securities transfer form and take it to your broker or financial institution. They will use the information to complete an internal transfer of securities form and submit it for processing. This process can take several weeks, so be sure to plan ahead and submit it before the end of the year if you would like to receive a tax receipt.

-

3. Send us your form and receive a tax receipt

Fill in Transfer FormSend a copy of the completed transfer form to lfernandes@tpl.ca. After the securities have been transferred into our brokerage account, we will confirm receipt and issue you a tax receipt.

Considering a Gift of Securities? Let’s talk.

Liza Fernandes

Vice President, Operations & Governance